Economy of the Republic of Ireland

2008/9 Schools Wikipedia Selection. Related subjects: Economics

| Economy of Ireland | |

|

|

| Currency | 1 Euro = 100 cent(s) |

|---|---|

| Fiscal year | Calendar year |

| Trade organisations | EU, WTO and OECD |

| Statistics | |

| GDP ( PPP) | €161.6 bn ( 2005) ( 48th) |

| GDP growth | 4.7% (2005 est.) |

| GDP per capita | $41,000 (2005 est.) |

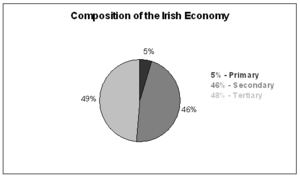

| GDP by sector | agriculture (5%), manufacturing (46%), services (49%) (2002) |

| Inflation ( CPI) | 3.9% ( 2006) |

| Population below poverty line |

10% (1997 est.) |

| Labour force | 2.154 million ( 2006 ) |

| Labour force by occupation |

services (64%), manufacturing (29%), agriculture (8%) ( 2005) |

| Unemployment | 4.4% ( July 2006) |

| Main industries | steel, lead, zinc, silver, aluminium, barite, and gypsum mining processing; food, brewing, textiles, clothing; chemicals, pharmacology; machinery, rail transportation equipment, passenger and commercial vehicles, ship construction and refurbishment; glass and crystal; computer software, tourism |

| External | |

| Exports | $102 billion f.o.b. (2005 est.) |

| Export goods | machinery and equipment, computers, chemicals, pharmaceuticals; live animals, animal products |

| Main export partners | United States 18.7%, United Kingdom 17.3%, Belgium 15.1%, Germany 7.3%, Netherlands 4.8% ( 2005) |

| Imports | $65.47 billion f.o.b. (2005 est.) |

| Import goods | data processing equipment, other machinery and equipment, chemicals, petroleum and petroleum products, textiles, clothing |

| Main import partners | UK 36.8%, United States 13.8%, Germany 9.1%, Netherlands 4.5% ( 2005) |

| Public finances | |

| Public debt | €37.2 bn (27% of GDP) ( June 2006) |

| Revenues | €44.3 bn ( 2006) |

| Expenses | €45.4 billion ( 2006) |

| Economic aid | donor: ODA, €735 mn ( 2005) |

| Main data source: CIA World Factbook All values, unless otherwise stated, are in US dollars |

|

|

Life in the Republic of Ireland |

|---|

|

Culture

Economy

General

Society

Politics

Policies

|

The economy of Ireland is modern and trade-dependent with growth averaging a robust 10% in 1995–2000. Agriculture, once the most important sector, is now dwarfed by industry, which accounts for 46% of GDP, about 80% of exports, and employs 29% of the labour force. Although exports remain the primary engine for Ireland's robust growth, the economy is also benefiting from a rise in consumer spending and recovery in both construction and business investment. The annual rate of inflation stands at 5.1% as of 2007, up from recent rates of between 3% and 4%. On the EU HICP inflation index, inflation is 2.7% , against an EU average of 1.8% . House price inflation has been a particular economic concern (average house price was €251,281 in February 2005). Unemployment is low but is rising and up to 30,000 jobs may be lost between 2007 and 2008 much of which is attributed to a slowdown in house building. Incomes have been rising rapidly as well as service charges ( utilities, insurance, healthcare, legal representation, etc.). Dublin, the nation's capital, was ranked 16th in a worldwide cost of living survey in 2006 (up from 22nd in 2004 and 24th in 2003).

Ireland has the second highest per capita income of any country in the EU next to Luxembourg, and fourth highest in the world based on measurements of Gross Domestic Product (GDP) per capita. Many economists feel that GDP per capita is an inappropriate measure of national income for Ireland because it does not consider the repatriation of profits by multinational companies. Gross National Income per capita, takes account of this. In any case, the vast majority of wealth held by Irish citizens is invested in property . Furthermore, the construction sector, which is inherently cyclical in nature, accounts for a significant component of Ireland's GDP and GNP and any downturn in this sector is likely to have a profound impact. In 2005, the World Bank measured Ireland's GNI per head at $41,140 - the seventh highest in the world, sixth highest in Western Europe, and the third highest of any EU member state.

History

The state known today as Ireland seceded from the United Kingdom in 1922. The state was troubled by poverty and emigration until the early 1990s. These problems virtually disappeared over the course of that decade, which saw the beginning of unprecedented economic growth, in a phenomenon known as the " Celtic Tiger". Over the past two decades, the Irish government has implemented a series of national economic programmes designed to curb inflation, ease tax burdens, reduce government spending as a percentage of GDP, increase labour force skills, and promote foreign investment. Ireland joined in launching the euro currency system in January 1999 along with ten other European Union countries. The economy felt the impact of the global economic slowdown in 2001, particularly in the high-tech export sector – the growth rate in that area was cut by nearly half. GDP growth continued to be exceptionally high in international terms, with a rate of about 6% in 2001 and 2002 – and it is expected to continue at more than 4 per cent (2006 onwards). Since 2001, GNI (which measures income to Irish residents rather than output) growth has been much slower.

Infrastructure

Ireland's transport infrastructure came under strain due to the economic expansion of the past decade. Since 1993, road transport has been coordinated by the National Roads Authority in the case of the National Primary Routes, which are the most heavily used roads, The National Secondary Routes act as regional roads and linkages between the primary routes. The Dublin area is served by a light rail network (the Luas), the Dublin Port Tunnel the M50, Dublin Airport, Dublin Suburban Rail and the DART.

Ireland's rail network is run by the semi-state body Iarnród Éireann, a subsidiary of CIÉ and is made up of 9 national lines and several regional commuter lines such as the DART. CIÉ retain some freight customers, though few new freight services have started in recent years. Only some major ports remain technically freight-connected, the connection at Sligo for example was removed in 2003, while the link to Foynes has remained unused since 1999. The efficiency of the train network is poor, with regular delays and overcrowding on major routes. Some regional routes have few services, and as a result, struggle to achieve passengers. Much new rolling stock has been acquired since 1994, and as of 2004, this is finally beginning to expand capacity rather than just replacing old stock. Most major routes have been relaid with continuous welded rail, and signalling has in most cases been upgraded from the more than century-old mechanical semaphores.

The country has a total of 15 airports and airfields, of which 3 - Dublin Airport, Shannon Airport and Cork Airport are of a substantial size. The country is served by several airlines, most notably Aer Lingus, Ryanair, Aer Arann, and CityJet. Air transport is relatively cheap. The main ports are Rosslare Europort, Limerick, Dublin, Cork and Waterford. There are daily ferry services to Britain.

In Telecommunications, the deregulated market has ensured that other licenced operators now account for a 32% share of the market.

Broadband is now available in Ireland via DSL, Cable, Wireless and Satellite . As of November 2007, DSL is available to c. 88% of homes and businesses. Overall takeup of broadband (cable, dsl, wireless etc.) is 15.4% as of July '07 and there are 698,000 broadband subscriptions as of September ’07 The average monthly subscription cost is $40.41, 20% cheaper than the average of $49 for the 35 OECD countries surveyed.

5% of lines connected to broadband-enabled exchanges cannot avail of DSL, due to distance and other issues.

The mobile market has four providers - 3 Ireland, O2 Ireland, Meteor and Vodafone Ireland. The electricity transmission system is run by the Electricity Supply Board and is available nationwide. The gas network is currently being expanded.

Energy

The vast majority of Irish energy needs are met by fossil fuels. About 98% of Ireland's final energy demand is produced by burning coal, petroleum, peat, or natural gas. This over reliance on fossil fuels - particularly oil - has left the Ireland vulnerable to international price fluctuations as it imports all of its oil needs. As part of its National Development Plan the Government adopted the Sustainable Energy Act (2002) and created Sustainable Energy Ireland as the nation's energy regulator. As part of their objectives to promote environmentally and economically sustainable energy production, electrical generation from peat consumption, as a percent of total electrical generation, was reduced from 18.8% to 6.1%, between 1990 and 2004. Likewise, coal consumption was reduced from 41.7% to 27.6%. Making up for this, the share of natural gas in electrical generation increased from 26.7% to 44.8%. Renewable energy, from biomass, wind and hydro, also increased from 1.9% to 2.6% in the same time period. A forecast by Sustainable Energy Ireland predicts that oil will no longer be used for electrical generation but natural gas will be dominant at 71.3% of the total share, coal at 9.2%, and renewable energy at 8.2% of the market. Wind power is quickly developing in the country by Airtricity and Hibernia Wind Energy (a subsidiary of the Electricity Supply Board) and many other companies. As of December 2005, there were fifty wind farms operational in Ireland with a combined capacity of 500 MW - generating enough energy for 300,000 homes, depending on wind conditions. In addition, a further 600 MW of wind farms (40 more) have signed connection agreements to link to the power system at high voltage or low voltage, and up to 200 MW of wind farms have received connection offers. Should these reach capacity, Ireland may exceed its EU target of 13.2 per cent of electricity generated from renewable sources by 2010. In addition to wind farms, electricity is also generated at large scale hydro schemes on the Shannon, Erne, Liffey and Lee rivers, and at mini-hydro stations, as well as landfill gas generating plants in Cork and Dublin cities.

- Statistics

- Electricity production: 23.41 billion kWh (2003)

- Energy production by source: oil: 55.8%, natural gas: 24.3%, coal: 12.9%; peat: 3.8%; renewables: 2.2%; nuclear: 0% (2004)

- Electricity consumption: 22.97 billion kWh (2003)

- Electricity exports: 0 (2003)

- Electricity imports: 1.2 billion kWh (2003)

- Oil consumption: 175,600 bbl/day (27,918 m³) per day (2003 est.)

- Natural gas production: 673 million m³ (2003 est.)

- Natural gas consumption: 4.298 billion m³ (2003 est.)

- Natural gas proved reserves: 19.82 billion m³ (As of 1 January 2002)

Monetary system

As the country is a member of the Economic and Monetary Union of the European Union, the euro is the currency. The most common bills in circulation are the €5, €10, €20 and €50, the €100, €200 and €500 bills are rarely seen. The Central Bank and Financial Services Authority of Ireland is the country's central bank and financial services regulator, and an agent for the European Central Bank which sets the interest rates. The low interest rates of the ECB - to stimulate the Eurozone - has helped to sustain the very high growth rate of Ireland, leading to high levels of inflation in the country. For example, increased inflation on housing, from IRE£9,000 (€11,430) in 1973 to €220,000 in 2004 has led to young couples accepting large mortgages and the wealthy buying investment properties. It is arguable that if Ireland had its own currency, interest rates would be higher and inflation would be reduced- however so would economic growth. Fears of overheating (that is excessive growth) of the economy due to the Euro seem to be unfounded, at least up to the present.

While there are over 60 credit institutions incorporated in Ireland, the banking system is dominated by the Big Four - AIB Bank, Bank of Ireland, Ulster Bank and National Irish Bank. There is a large Credit Union movement within the country which offers an alternative to the banks. The Irish Stock Exchange is in Dublin, however, due to its small size, many firms also maintain listings on either the London Stock Exchange or the NASDAQ. The insurance industry in Ireland is a leader in both retail markets and corporate customers in the EU, in large part due to the International Financial Services Centre.

Economic sectors

The Irish economy's secondary and tertiary sectors are of a similar size in fiscal terms however in terms of labour, the tertiary sector is far larger. Similarly in fiscal terms the primary sector appears small, however it still employs about 8% of the workforce.

Primary sector

The primary sector constitutes 5% of Irish GDP, and 8% of Irish employment. Ireland's main economic resource is its large fertile pastures, particularly the midland and southern regions. In 2004, Ireland exported approximately €7.15 billion worth of agri-food and drink (about 8.4% of Ireland's exports), mainly as cattle, beef, and dairy products, and mainly to the United Kingdom. As the European Union's Common Agricultural Policy takes force Ireland's agriculture industry is expected to decline in importance.

Due to unsustainable nineteenth century forestry practices the island was mostly deforested. In 2005, after years of national afforestation programs, about 9% of Ireland has become forested. It is still the least forested country in the EU and heavily relies on imported wood. Its coastline - once abundant in fish, particularly cod - has suffered overfishing and since 1995 the fisheries industry has focused more on aquaculture. Freshwater salmon and trout stocks in Ireland's waterways have also been depleted but are being better managed. Ireland is a major exporter of zinc to the EU and mining also produces significant quantities of lead and alumina. Beyond this, the country has significant deposits of gypsum, limestone, and smaller quantities of copper, silver, gold, barite, and dolomite. Peat extraction has historically been important, especially from midland bogs, however more efficient fuels and environmental protection of bogs has reduced peat's importance to the economy. Natural gas extraction occurs in the Kinsale Gas Field and the Corrib Gas Field in the southern and western counties, where there is 19.82 bn cubic metres of proven reserves.

Secondary sector

The secondary sector constitutes 46% of Irish GDP — but only 29% of the labour force. Dominated for many years by textile companies like Fruit of the Loom, the sector is now largely made up of high-tech/high value multi-nationals such as Dell, Intel, Pfizer and IBM. The secondary sector in Ireland manufactures products such as computers (25% of Europe's computers are made in Ireland, the European Headquarters of Apple Computer are in Cork City), computer parts (Intel processors are made in Ireland), drugs (much of Europe's supply of Viagra is made in Cork), confectionery ( HB, Jacobs and Cadbury-Schweppes all have significant Irish operations - although Cadbury-Schweppes does not manufacture Schweppes products in Ireland or the UK), beer (the Guinness and Smithwicks, and Harp Lager breweries are located in Ireland), high quality glass and crystal ( Waterford Crystal is made in County Waterford), software (Ireland is the world's largest exporter of software - Oracle and Microsoft both have large operations in Dublin) and machinery. The sector faces increasing competition from cheaper Eastern European countries such as Poland and many Asian countries such as the People's Republic of China, particularly in the lower skill areas such as confectionery manufacturing. The industrial production growth rate in 2003 was 6.7%. Over the last decade, construction has become a major component of the economy, currently constituting 9% of economic activity. A recent downturn in residential property market sentiment, combined with the cyclical nature of construction has highlighted the over-exposure of the Irish economy to construction, which now presents a threat to economic growth.

Tertiary sector

The tertiary sector constitutes 49% of Irish GDP and 64% of Irish employment. The tertiary sector is by far the largest driver of modern Irish economic growth — the Celtic Tiger. It is made up of several industries such as accountancy, legal services, call centres and customer service operations, finance and stock broking, catering, and tourism. Many US firms (such as IBM and Apple Computer) located their European customer service operations in Ireland due to the availability of a young, highly educated, English speaking workforce. Recruitment agencies also play a major role in this sector, connecting qualified work candidates to business clients looking to hire in these areas. The Irish tourism industry attracts over five million visitors annually and employs over 100,000. The IFSC in Dublin created some 14,000 jobs in the 1990s, all in the high-value finance and legal sectors. The hospitality and retail sectors are quite large — there are hundreds of domestic and foreign retail firms in Ireland (such as Next and Argos), and most cafe and restaurant firms operate in Ireland such as McDonalds, Starbucks, Burger King and Subway.

State role in the economy

State ownership

At present the Irish Government controls several large and key parts of the economy:

- Through Córas Iompair Éireann (CIE) it controls most of the bus and all of the railway market. A significant portion of the scheduled land transport services are accounted for through CIE companies.

- Through the Electricity Supply Board (ESB) the government controls much of the electricity generation market, and all of the electricity transmission network.

- Through RTÉ the government control much of the radio and television broadcast sector, although commercial enterprises are gaining market share. The state does not generally use the media it owns to spread propaganda, but it has a large financial and regulatory control of the sector.

- Through An Post, the government has a monopoly of the light mail delivery industry and a large portion of the partially deregulated parcel and express delivery market.

Although the government owns the incumbents in the electricity, mail, broadcasting, land transport and air transport industries, many are wholly or partially open to competition from the private sector. Traditionally large and key sectors of the economy were dominated by government ownership. Some of these industries are currently being reformed and opened to competition however some of them are regarded as being slow to adopt change and reform to work practice — work pay and conditions are often much better than that in the private sector with some having overstaffing or underproductivity which is seen as an impediment to reform.

The government in 2006 privatised Aer Lingus and is currently considering the privatisation of part of the Electricity Supply Board, but it is somewhat reluctant because of an earlier situation that resulted from the privatisation of Eircom. In that case, hundreds of thousands of small shareholders lost money, private investors took control and established a virtual monopoly, while under-investment led to a slow roll out of broadband infrastructure.

Taxation

The present government (1997–) has favoured a low taxation policy to encourage foreign direct investment in Ireland. Consequently, the government opposes moves by the European Commission to restrict tax competition. The previous government of 1994-1997 introduced a corporate tax rate is only 12.5%, versus between 15% and 60% in the rest of Europe. The income tax system is designed to redistribute wealth from the richer to the poorer segments of society. There are 2 tax bands, based on income levels. These range from a maximum top rate of 41%, to a maximum bottom rate of 20%. In reality, however, a generous tax credits system ensures that the lower rates of taxation are normally 4% to 12%. The top rate of tax never exceeds 35% in practice.

The government receives much of its revenues from taxes on goods — these include a 21% VAT rate on most consumer goods, high levels of excise duty on tobacco, petrol, and alcohol and several smaller taxes on items such as plastic bags, cheques, ATM cards, credit cards and debit cards. The taxes in the personal financial sector, as well as the television licence, are often seen as regressive.

The welfare state

The Irish government runs a Welfare state system. The government provides free education at all levels for all EU citizens. Hospital care is free to all, though lower earners or people dependant on benefits receive all medical services for no charge, including dental, oral and aural services. People who are unemployed receive unemployment benefits and retired people are entitled to a state pension - both benefits are quite high by international comparisons. However, recent changes in the cost of living in Ireland have greatly eroded their relative buying power. Pension payments will increase to €200 (non-contributory) and €209.30 (contributory) per week in 2007.

Health care

Education

The education system is comparatively very good with standards in mathematics, science and technology being among the highest in OECD member nations. The state has a virtual monopoly in higher education — there are few private colleges and these are highly specialised. The primary and secondary school enrolment levels are over 95% and at these levels choice is wide. Third level entry is competitive; all college and university tuition fees are free and courses adjusted to the needs of the economy. Irish adult literacy is 99% — in line with other OECD countries.

The only recognized universities are Dublin City University, National University of Ireland (with constituent universities at Cork, Dublin, Galway and Maynooth), University of Limerick and University of Dublin. The Institute of Technology system has recently overtaken the universities in terms of first year enrolment numbers and this trend appears to be accelerating.

Economic ties

United States

In 2003, trade between Ireland and the United States was worth around $33 billion, a $4 billion increase over 2002. U.S. exports to Ireland were valued at $7.7 billion, an increase of almost $1 billion over 2002. Irish exports to the U.S. were worth some $25.7 billion — a 500% increase since 1997. Ireland had a trade surplus of over $15 billion with the U.S. in 2003. The range of U.S. products imported to Ireland includes electrical components, computers and peripherals, drugs and pharmaceuticals, electrical equipment, and livestock feed. Exports to the United States include alcoholic beverages, chemicals and related products, electronic data processing equipment, electrical machinery, textiles and clothing, and glassware.

U.S. foreign direct investment in Ireland has been particularly important to the growth and modernization of Irish industry since 1980, providing new technology, export capabilities, and employment opportunities. The major U.S. investments in Ireland to date have included multi-billion dollar investments by Intel, Dell, Microsoft, IBM and Abbott Laboratories. Currently, there are more than 600 U.S. subsidiaries operating in Ireland, employing in excess of 100,000 people and spanning activities from manufacturing of high-tech electronics, computer products, medical supplies, and pharmaceuticals to retailing, banking and finance, and other services. Many U.S. businesses find Ireland an attractive location to manufacture for the EU market, since as a member of the EU it has tariff free access to the European Common Market. Government policies are generally formulated to facilitate trade and inward direct investment. The availability of an educated, well-trained, English-speaking work force and relatively moderate wage costs have been important factors. Ireland offers good long-term growth prospects for U.S. companies under an innovative financial incentive programme, including capital grants and favourable tax treatment, such as a low corporation income tax rate for manufacturing firms and certain financial services firms.

European Union

Although the USA is the single most important economic partner, it lags by far the EU as a whole which accounts for 63.3% of Ireland's exports (US 18.7%) and 57.4% of her imports (US 14.1%). (data for 2005).

Ireland has grown much closer to Europe in recent years — particularly since it joined the European Union (EU) in 1973. It is also part of the EMU and thus has the euro as its currency. Many US companies have located their European headquarters in Ireland and this has led to increased Irish-European ties. Ireland regularly comes near the top in polls of the most enthusiastic Europeans and spent some €60m during its presidency of the EU. The EU now accounts for the bulk of Irish trade, with the United Kingdom being the largest trading partner. Ireland's main exports to Europe are beef, computers ( Dell, HP, EMC, and Apple Computer all have manufacturing facilities in Ireland) and software ( Oracle and Microsoft have their European Headquarters in Ireland). Ireland's major imports from Europe include cars, machinery, trucks, steel, oil and consumer goods. A major economic bonus Ireland has received from EU membership has been agricultural subsidies from the CAP and large amounts of EU investment in Irish road infrastructure. Since the acceptance of the 10 new Eastern European nations in 2004, Ireland's ties with Europe further increased. Since the accession event in 2004, several hundred thousand workers from countries such as Latvia, Poland and Estonia, no longer requiring work permits, came to live and work in Ireland.

Wealth distribution

Like many Western democracies wealth is partially redistributed among the poorer segments of society through the progressive tax system. Large disparities in wealth exist between those employed and those dependent on welfare payments. The percentage of the population at risk of relative poverty was 21% in 2004 - one of the highest rates in the European Union. Levels of wealth higher than the national average are concentrated among people living in the central eastern region and in Dublin. Despite this, there are many areas in Dublin marked by relative poverty, particularly in the inner city. The poorest members of society are those entirely dependent on welfare payments. Ireland's inequality of income distribution score on the Gini coefficient scale was 30.4 in 2000, slightly below the OECD average of 31. Ireland's 2000 score was less than 9 of the OECD member states but higher than 13 members. This has changed substantially since these statistics were published (see Recent Developments).

The national minimum wage is €8.65 per hour for full time staff over the age of 18 — this is one of the highest in the world. It is above the threshold for free healthcare assuming that the individual is single, has no children and works full-time. From 2007, someone working 39 hours per week at this rate will be exempt from income tax, as income below €17,600 per year will not be taxed. Unemployment benefit (the dole) and Jobseeker's Allowance for a single person in Ireland will be €181.80 per week, as of January 2007. This compares to £57.45 (€83.10) per week for a single person aged 25 or over in the UK.

In contrast to most other countries in the European Union (with the exception of the UK, Greece and Hungary) Ireland has high rates of home ownership. In particular, house ownership (at approximately 80%) is the norm. In Continental Europe renting is the norm. Social housing schemes do exist and the government has invested €8.5 billion in the provision of over 34,000 social housing units between 2000 and 2005. Average rents for 2 bedroom apartments in Dublin range from €1,069.00 to €1,269.00 per four-week period. A single person living in shared accommodation can receive up to €98.00 per week (€392.00 every 4 weeks) in rent supplement. Therefore house sharing in rented accommodation is quite common in Ireland among single people receiving welfare payments and single people on low pay.

Recent Developments

In recent years, large and sustained increases in property values have had a substantial impact on the distribution of wealth. The high level of inequality in Ireland today is evident from an annual publication issued by the Bank of Ireland detailing the sources of wealth in Ireland.