Corporation

2008/9 Schools Wikipedia Selection. Related subjects: Business

A corporation is a legal personality, usually used to conduct business. Corporations exist as a product of corporate law, and their rules balance the interests of the shareholders that invest their capital and the employees who contribute their labour. People work together in corporations to produce. In modern times, corporations have become an increasingly dominant part of economic life. People rely on corporations for employment, for their goods and services, for the value of the pensions, for economic growth and social development.

The defining feature of a corporation is its legal independence from the people who create it. If a corporation fails, shareholders will lose their money, and employees will lose their jobs, but neither will be liable for debts that remain owing to the corporation's creditors. This rule is called limited liability, and it is why corporations end with " Ltd." (or some variant like " Inc." and " plc"). In the words of British judge, Walton J, a company is...

"...only a juristic figment of the imagination, lacking both a body to be kicked and a soul to be damned."

But despite this, corporations are recognised by the law to have rights and responsibilities like actual people. Corporations can exercise human rights against real individuals and the state, and they may be responsible for human rights violations. Just as they are "born" into existence through its members obtaining a certificate of incorporation, they can "die" when they lose money into insolvency. Corporations can even be convicted of criminal offences, such as fraud and manslaughter. Five common characteristics of the modern corporation, according to Harvard University Professors Hansmann and Kraakman are...

- separate legal personality of the corporation (the right to sue and be sued in its own name)

- limited liability of the shareholders (so that when the company is insolvent, they only owe the money that they subscribed for in shares)

- transferrable shares (usually on a listed exchange, such as the London Stock Exchange, New York Stock Exchange or Euronext in Paris)

- delegated management, in other words, control of the company placed in the hands of a board of directors

- investor ownership, which Hansmann and Kraakman take to mean, ownership by shareholders.

Ownership of a corporation is complicated by increasing social and economic interdependence, as different stakeholders compete to have a say in corporate affairs. In most developed countries excluding the English speaking world, company boards have representatives of both shareholders and employees to " codetermine" company strategy. Calls for increasing corporate social responsibility are made by consumer, environmental and human rights activists, and this has led to larger corporations drawing up codes of conduct. In Australia, Canada, the United Kingdom and the United States, corporate law has not yet stepped into that field, and its building blocks remain the study of corporate governance and corporate finance.

Corporations' history

The word "corporation" derives from corpus, the Latin word for body, or a "body of people". Entities which carried on business and were the subjects of legal rights were found in ancient Rome, ancient India and the Maurya Empire. In mediaeval Europe, churches became incorporated, as did local governments, such as the Pope and the City of London Corporation. The point was that the incorporation would survive longer than the lives of any particular member, existing in perpetuity. The alleged oldest commercial corporation in the world, the Stora Kopparberg mining community in Falun, Sweden, obtained a charter from King Magnus Eriksson in 1347. Many European nations chartered corporations to lead colonial ventures, such as the Dutch East India Company or the Hudson's Bay Company, and these corporations came to play a large part in the history of corporate colonialism.

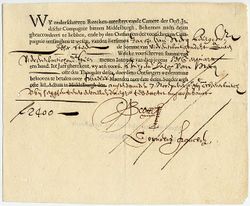

During the period of colonial expansion, in the seventeenth century, the true progenitors of the modern Corporation emerged as the "chartered company". Acting under a charter sanctioned by the Dutch monarch, the Vereenidge Oost-Indische Compagnie (VOC), or the Dutch East India Company, defeated Portuguese forces and established itself in the Moluccan Islands in order to profit off the European demand for spices. Investors in the VOC were issues paper certificates as proof of share ownership, and were able to trade their shares on the original Amsterdam stock exchange. Shareholders are also explicitly granted limited liability in the company's royal charter. In the late seventeenth century, Stewart Kyd, the author of the first treatise on corporate law in English, defined a corporation as,

"a collection of many individuals united into one body, under a special denomination, having perpetual succession under an artificial form, and vested, by policy of the law, with the capacity of acting, in several respects, as an individual, particularly of taking and granting property, of contracting obligations, and of suing and being sued, of enjoying privileges and immunities in common, and of exercising a variety of political rights, more or less extensive, according to the design of its institution, or the powers conferred upon it, either at the time of its creation, or at any subsequent period of its existence."

Mercantilism

Labelled by both contemporaries and historians as "the grandest society of merchants in the universe", the British East India Company would come to symbolize the dazzingly rich potential of the corporation, as well as new methods of business that could be both brutal and exploitive. On December 31, 1600, the English monarchy granted the company a fifteen-year monopoly on trade to and from the East Indies and Africa. By 1611 shareholders in the East India Company were earning an almost 150% return on their investment. Subsequent stock offerings demonstrated just how lucrative the Company had become. Its first stock offering in 1613-1616 raised ₤418,000, and its second offering in 1617-1622 raised ₤1.6 million.

In the United States, government chartering began to fall out of vogue in the mid-1800s. Corporate law at the time was focused on protection of the public interest, and not on the interests of corporate shareholders. Corporate charters were closely regulated by the states. Forming a corporation usually required an act of legislature. Investors generally had to be given an equal say in corporate governance, and corporations were required to comply with the purposes expressed in their charters. Many private firms in the 19th century avoided the corporate model for these reasons (Andrew Carnegie formed his steel operation as a limited partnership, and John D. Rockefeller set up Standard Oil as a trust). Eventually, state governments began to realize the greater corporate registration revenues available by providing more permissive corporate laws. New Jersey was the first state to adopt an "enabling" corporate law, with the goal of attracting more business to the state. Delaware followed, and soon became known as the most corporation-friendly state in the country after New Jersey raised taxes on the corporations, driving them out. New Jersey reduced these taxes after this mistake was realized, but by then it was too late; even today, most major public corporations are set up under Delaware law.

By the beginning of the nineteenth century, government policy on both sides of the Atlantic began to change, reflecting the growing popularity of the proposition that corporations were riding the economic wave of the future. In 1819, the U.S. Supreme Court granted corporations a plethora of rights they had not previously recognized or enjoyed. Corporate charters were deemed "inviolable," and not subject to arbitrary amendment or abolition by state governments. The Corporation as a whole was labeled an "artificial person," possessing both individuality and immortality.

At around the same time as the above events were occurring in the United States, British legislation was similarly freeing the corporation from the shackles of historical restrictions. In 1844 British Parliament passed the Joint Stock Companies Act, which allowed companies to incorporate without a royal charter or an additional act of Parliament. Ten years later, England enshrined into law the preeminent hallmark of modern corporate law - the concept of limited liability. Acting in response to increasing pressure from newly emerging capital interests, Parliament passed the Limited Liability Act of 1855, which established the principle that any corporation could enjoy limited legal liability on both contract and tort claims simply by registering as a "limited" company with the appropriate government agency.

This revolutionary switch from unlimited to limited liability prompted a writer for the English periodical Economist to write in 1855 that "never, perhaps, was a change so vehemently and generally demanded, of which the importance was so much overrated." The glaring inaccuracy of the second part of this judgment was recognized by the same magazine more than seventy-five years later, when it claimed that, "[t]he economic historian of the future . . . may be inclined to assign to the nameless inventor of the principle of limited liability, as applied to trading corporations, a place of honour with Watt and Stephenson, and other pioneers of the Industrial Revolution."

Modern corporations

By the end of the nineteenth century the forces of limited liability, state and national deregulation, and vastly increasing capital markets had come together to give birth to the corporation in its modern-day form. The well-known Santa Clara County v. Southern Pacific Railroad decision began to influence policymaking. The decline of restrictions on mergers and acquisitions encouraged a wave of corporate consolidation: from 1898 to 1904, 1,800 U.S. corporations were consolidated into 157. The modern corporate era had begun.

The 20th century saw a proliferation of enabling law across the world, which some argue helped to drive economic booms in many countries before and after World War I. Starting in the 1980s, many countries with large state-owned corporations moved toward privatization, the selling of publicly owned services and enterprises to corporations. Deregulation -- reducing the public-interest regulation of corporate activity -- often accompanied privatization as part of an ideologically laissez-faire policy. Another major postwar shift was toward the development of conglomerates, in which large corporations purchased smaller corporations to expand their industrial base. Japanese firms developed a horizontal conglomeration model, the keiretsu, which was later duplicated in other countries as well.

Corporate law

The existence of a corporation requires a special legal framework and body of law that specifically grants the corporation legal personality, and typically views a corporation as a fictional person, a legal person, or a moral person (as opposed to a natural person). As such, corporate statutes typically give corporations the ability to own property, sign binding contracts, pay taxes in a capacity that is separate from that of its shareholders (who are sometimes referred to as "members". According to Lord Chancellor Haldane,

"...a corporation is an abstraction. It has no mind of its own any more than it has a body of its own; its active and directing will must consequently be sought in the person of somebody who is really the directing mind and will of the corporation, the very ego and centre of the personality of the corporation."

The legal personality has two economic implications. First it grants creditors priority over the corporate assets upon liquidation. Second, corporate assets cannot be withdrawn by its shareholders, nor can the assets of the firm be taken by personal creditors of its shareholders. The second feature requires special legislation and a special legal framework, as it cannot be reproduced via standard contract law.

The regulations most favorable to incorporation include:

- Limited liability

- Unlike in a partnership or sole proprietorship, shareholders of a modern business corporation have "limited" liability for the corporation's debts and obligations. As a result their potential losses cannot exceed the amount which they contributed to the corporation as dues or paid for shares. Limited liability regulations enable corporations to socialize their costs for the primary benefit of shareholders. The economic rationale for this lies in the fact that it allows anonymous trading in the shares of the corporation by virtue of eliminating the corporation's creditors as a stakeholder in such a transaction. Without limited liability, a creditor would not likely allow any share to be sold to a buyer of at least equivalent creditworthiness as the seller. Limited liability further allows corporations to raise tremendously more funds for enterprises by combining funds from the owners of stock. Limited liability reduces the amount that a shareholder can lose in a company. This in turn greatly reduces the risk for potential shareholders and increases both the number of willing shareholders and the amount they are likely to invest.

- Perpetual lifetime

- Another favorable regulation, the assets and structure of the corporation exist beyond the lifetime of any of its shareholders, bondholders, or employees. This allows for stability and accumulation of capital, which thus becomes available for investment in projects of a larger size and over a longer term than if the corporate assets remained subject to dissolution and distribution. This feature also had great importance in the medieval period, when land donated to the Church (a corporation) would not generate the feudal fees that a lord could claim upon a landholder's death. In this regard, see Statute of Mortmain. It is important to note that the "perpetual lifetime" feature is an indication of the unbounded potential duration of the corporation's existence, and its accumulation of wealth and thus power. (In theory, a corporation can have its charter revoked at any time, putting an end to its existence as a legal entity. However, in practice, dissolution only occurs for corporations that request it or fail to meet annual filing requirements.)

Ownership and control

Persons and other legal entities composed of persons (such as trusts and other corporations) can have the right to vote or share in the profit of corporations. In the case of for-profit corporations, these voters hold shares of stock and are thus called shareholders or stockholders. When no stockholders exist, a corporation may exist as a non-stock corporation, and instead of having stockholders, the corporation has members who have the right to vote on its operations. If the non-stock corporation is not operated for profit, it is called a not-for-profit corporation. In either category, the corporation comprises a collective of individuals with a distinct legal status and with special privileges not provided to ordinary unincorporated businesses, to voluntary associations, or to groups of individuals.

For the purposes of the next few paragraphs, the term "members" will be used to refer to stockholders of a stock corporation and members of a non-stock corporation.

There are two broad classes of corporate governance forms in the world. In most of the world, control of the corporation is determined by a board of directors which is elected by the shareholders. In some jurisdictions, such as Germany, the control of the corporation is divided into two tiers with a supervisory board which elects a managing board. Germany is also unique in having a system known as co-determination in which half of the supervisory board consists of representatives of the employees. The CEO, president, treasurer, and other titled officers are usually chosen by the board to manage the affairs of the corporation.

In addition to the influence of shareholders, corporations can be controlled (in part) by creditors such as banks. In return for lending money to the corporation, creditors can demand a controlling interest analogous to that of a member, including one or more seats on the board of directors. In some jurisdictions, such as Germany and Japan, it is standard for banks to own shares in corporations whereas in other jurisdictions such as the United States and the United Kingdom banks are prohibited from owning shares in external corporation.

Members of a corporation (except for non-profit corporations) are said to have a "residual interest." Should the corporation end its existence, the members are the last to receive its assets, following creditors and others with interests in the corporation. This can make investment in a corporation risky; however, a diverse investment portfolio minimizes this risk. In addition, shareholders receive the benefit of limited liability regulations, making shareholders liable for only the amount they contributed. This only applies in the case of for-profit corporations; non-profits are not allowed to have residual benefits available to the members.

Formation

Historically, corporations were created by special charter of governments. Today, corporations are usually registered with the state, province, or national government and become regulated by the laws enacted by that government. Registration is the main prerequisite to the corporation's assumption of limited liability. As part of this registration, it must in many cases be required to designate the principal address of the corporation as well as a registered agent (a person or company that is designated to receive legal service of process). As part of the registration, it may also be required to designate an agent or other legal representative of the corporation depending on the filing jurisdiction.

Generally, a corporation files articles of incorporation with the government, laying out the general nature of the corporation, the amount of stock it is authorized to issue, and the names and addresses of directors. Once the articles are approved, the corporation's directors meet to create bylaws that govern the internal functions of the corporation, such as meeting procedures and officer positions.

The law of the jurisdiction in which a corporation operates will regulate most of its internal activities, as well as its finances. If a corporation operates outside its home state, it is often required to register with other governments as a foreign corporation, and is almost always subject to laws of its host state pertaining to employment, crimes, contracts, civil actions, and the like.

Naming

Corporations generally have a distinct name. Historically, some corporations were named after their membership: for instance, "The President and Fellows of Harvard College." Nowadays, corporations in most jurisdictions have a distinct name that does not need to make reference to their membership. In Canada, this possibility is taken to its logical extreme: many smaller Canadian corporations have no names at all, merely numbers based on their Provincial Sales Tax registration number (e.g., "12345678 Ontario Limited").

In most countries, corporate names include the term "Corporation", or an abbreviation that denotes the corporate status of the entity. These terms vary by jurisdiction and language. In some jurisdictions they are mandatory, and in others they are not. Their use puts all persons on constructive notice that they have to deal with an entity whose liability remains limited, in the sense that it does not reach back to the persons who constitute the entity; one can only collect from whatever assets the entity still controls at the time one obtains a judgment against it.

Certain jurisdictions do not allow the use of the word "company" alone to denote corporate status, since the word "company" may refer to a partnership or to a sole proprietorship, or even, archaically, to a group of not necessarily related people (for example, those staying in a tavern).

Unresolved issues

The nature of the corporation continues to evolve in response to new situations as existing corporations promote new ideas and structures, the courts respond, and governments issue new regulations. A question of long standing is that of diffused responsibility. For example, if a corporation is found liable for a death, how should culpability and punishment for it be allocated among shareholders, directors, management and staff, and the corporation itself? See corporate liability, and specifically, corporate manslaughter.

The law differs among jurisdictions, and is in a state of flux. Some argue that shareholders should be ultimately responsible in such circumstances, forcing them to consider issues other than profit when investing, but a corporation may have millions of small shareholders who know nothing about its business activities. Moreover, traders — especially hedge funds — may turn over shares in corporations many times a day.The issue of corporate repeat offenders (see H. Glasbeak, "Wealth by Stealth: Corporate Crime, Corporate Law, and the Perversion of Democracy" (Between the Lines Press: Toronto 2002) raises the question of the so-called "death penalty for corporations."

Types of corporations

Most corporations are registered with the local jurisdiction as either a stock corporation or a non-stock corporation. Stock corporations sell stock to generate capital. A stock corporation is generally a for-profit corporation. A non-stock corporation does not have stockholders, but may have members who have voting rights in the corporation.

Some jurisdictions (Washington, D.C., for example) separate corporations into for-profit and non-profit, as opposed to dividing into stock and non-stock.

For-profit and non-profit

In modern economic systems, conventions of corporate governance commonly appear in a wide variety of business and non-profit activities. Though the laws governing these creatures of statute often differ, the courts often interpret provisions of the law that apply to profit-making enterprises in the same manner (or in a similar manner) when applying principles to non-profit organizations — as the underlying structures of these two types of entity often resemble each other.

Closely held and public

The institution most often referenced by the word "corporation" is a public or publicly traded corporation, the shares of which are traded on a public stock exchange (e.g., the New York Stock Exchange or Nasdaq in the United States) where shares of stock of corporations are bought and sold by and to the general public. Most of the largest businesses in the world are publicly traded corporations. However, the majority of corporations are said to be closely held, privately held or close corporations, meaning that no ready market exists for the trading of shares. Many such corporations are owned and managed by a small group of businesspeople or companies, although the size of such a corporation can be as vast as the largest public corporations.

Closely held corporations do have some advantages over publicly traded corporations. A small, closely held company can often make company-changing decisions much more rapidly than a publicly traded company. A publicly traded company is also at the mercy of the market, having capital flow in and out based not only on what the company is doing but the market and even what the competitors are doing. Publicly traded companies also have advantages over their closely held counterparts. Publicly traded companies often have more working capital and can delegate debt throughout all shareholders. This means that people invested in a publicly traded company will each take a much smaller hit to their own capital as opposed to those involved with a closely held corporation. Publicly traded companies though suffer from this exact advantage. A closely held corporation can often voluntarily take a hit to profit with little to no repercussions (as long as it is not a sustained loss). A publicly traded company though often comes under extreme scrutiny if profit and growth are not evident to stock holders, thus stock holders may sell, further damaging the company. Often this blow is enough to make a small public company fail.

Often communities benefit from a closely held company more so than from a public company. A closely held company is far more likely to stay in a single place that has treated them well, even if going through hard times. The shareholders can incur some of the damage the company may receive from a bad year or slow period in the company profits. Workers benefit in that closely held companies often have a better relationship with workers. In larger, publicly traded companies, often when a year has gone badly the first area to feel the effects are the work force with lay offs or worker hours, wages or benefits being cut. Again, in a closely held business the shareholders can incur this profit damage rather than passing it to the workers. Closely held businesses are also often known to be more socially responsible than publicly traded companies.

The affairs of publicly traded and closely held corporations are similar in many respects. The main difference in most countries is that publicly traded corporations have the burden of complying with additional securities laws, which (especially in the U.S.) may require additional periodic disclosure (with more stringent requirements), stricter corporate governance standards, and additional procedural obligations in connection with major corporate transactions (e.g. mergers) or events (e.g. elections of directors).

A closely held corporation may be a subsidiary of another corporation (its parent company), which may itself be either a closely held or a public corporation.

Mutual benefit corporations

A mutual benefit nonprofit corporation is a corporation formed in the United States solely for the benefit of its members. An example of a mutual benefit nonprofit corporation is a golf club. Individuals pay to join the club, memberships may be bought and sold, and any property owned by the club is distributed to its members if the club dissolves. The club can decide, in its corporate bylaws, how many members to have, and who can be a member. Generally, while it is a nonprofit corporation, a mutual benefit corporation is not a charity. Because it is not a charity, a mutual benefit nonprofit corporation cannot obtain 501(c)(3) status. If there is a dispute as to how a mutual benefit nonprofit corporation is being operated, it is up to the members to resolve the dispute since the corporation exists to solely serve the needs of its membership and not the general public.

Corporations globally

Following on the success of the corporate model at a national level, many corporations have become transnational or multinational corporations: growing beyond national boundaries to attain sometimes remarkable positions of power and influence in the process of globalizing.

The typical "transnational" or "multinational" may fit into a web of overlapping shareholders and directorships, with multiple branches and lines in different regions, many such sub-groupings comprising corporations in their own right. Growth by expansion may favour national or regional branches; growth by acquisition or merger can result in a plethora of groupings scattered around and/or spanning the globe, with structures and names which do not always make clear the structures of shareholder ownership and interaction.

In the spread of corporations across multiple continents, the importance of corporate culture has grown as a unifying factor and a counterweight to local national sensibilities and cultural awareness.

Australia

In Australia corporations are registered and regulated by the Commonwealth Government through the Australian Securities and Investments Commission. Corporations law has been largely codified in the Corporations Act 2001.

Brazil

In Brazil there are many different types of corporations ("sociedades"), but the two most common ones commercially speaking are: (i) "sociedade limitada", identified by "Ltda." after the company's name, equivalent to the British limited company, and (ii) "sociedade anônima" or "companhia", identified by "SA" or "Companhia" in the company's name, equivalent to the British public limited company. The "Ltda." is mainly governed by the new Civil Code, enacted in 2002, and the "SA" by the Law 6.404 dated 15 December 1976.

Canada

In Canada both the federal government and the provinces have corporate statutes, and thus a corporation may have a provincial or a federal charter. Many older corporations in Canada stem from Acts of Parliament passed before the introduction of general corporation law. The oldest corporation in Canada is the Hudson's Bay Company; though its business has always been based in Canada, its Royal Charter was issued in England by King Charles II in 1670, and became a Canadian charter by amendment in 1970 when it moved its corporate headquarters from London to Canada. Federally recognized corporations are regulated by the Canada Business Corporations Act.

German-speaking countries

Germany, Austria, Switzerland and Liechtenstein recognize two forms of corporation: the Aktiengesellschaft (AG), analogous to public corporations in the English-speaking world, and the Gesellschaft mit beschränkter Haftung (GmbH), similar to (and an inspiration for) the modern limited liability company.

Italy

Italy recognises two forms of companies with limited liability: "S.r.l", or "Società a Responsabilità Limitata" (similar to Limited liability company) and "S.p.A" or "Società Per Azioni" (similar to American stock corporation).

Japan

The predominant form of business corporation in Japan is the kabushiki kaisha, used by public corporations as well as smaller enterprises. Mochibun kaisha, a form for smaller enterprises, are becoming increasingly common.

United Kingdom

In the United Kingdom, 'corporation' most commonly refers to a body corporate formed by Royal Charter or by statute, of which few now remain. The BBC is the oldest and best known corporation still in existence. Others, such as the British Steel Corporation, were privatized in the 1980s.

In the private sector, corporations are referred to in law as companies, and are regulated by the Companies Act 2006 (or the Northern Ireland equivalent). The most common type of company is the private limited company ("Limited" or "Ltd."). Private limited companies can either be limited by shares or by guarantee. Other corporate forms include the public limited company ("PLC") and the unlimited company.

United States

Several types of corporations exist in the United States. Generically, any business entity that is recognized as distinct from the people who own it (i.e., is not a sole proprietorship or a partnership) is a corporation. This generic label includes entities that are known by such legal labels as ‘association’, ‘organization’ and ‘limited liability company’, as well as corporations proper. Only a company that has been formally incorporated according to the laws of a particular state is called ‘corporation’. American corporations can be either profit-making companies or non-profit entities. Tax-exempt non-profit corporations are often called “501(c)3 corporation”, after the section of the Internal Revenue Code that addresses their tax exemption.

Corporations are created by filing the requisite documents with a particular state government. The process is called “incorporation,” referring to the abstract concept of clothing the entity with a "veil" of artificial personhood (embodying, or “corporating” it, ‘corpus’ being the Latin word for ‘body’). Only certain corporations, including banks, are chartered. Others simply file their articles of incorporation with the state government as part of a registration process.

The federal government can only create corporate entities pursuant to relevant powers in the U.S. Constitution. For example, Congress has constitutional power to regulate banking, so it has power to charter federal banks. Additionally, Congress has power to create and own corporations that serve a purpose of the federal government, such as Amtrak or the Federal Deposit Insurance Corporation.

Once incorporated, the corporation has artificial personhood everywhere it may operate, until such time as the corporation may be dissolved. A corporation that operates in one state while being incorporated in another is a “foreign corporation.” This label also applies to corporations incorporated outside of the United States. Foreign corporations must usually register with the secretary of state’s office in each state to lawfully conduct business in that state.

A corporation is legally a citizen of the state (or other jurisdiction) in which it is incorporated (except when circumstances direct the corporation be classified as a citizen of the state in which it has its head office, or the state in which it does the majority of its business). Corporate business law differs from state to state, and many prospective corporations choose to incorporate in a state whose laws are most favorable to its business interests. Many large corporations are incorporated in Delaware, for example, without being physically located there because that state has very favorable corporate tax and disclosure laws.

Companies set up for privacy or asset protection often incorporate in Nevada, which does not require disclosure of share ownership. Many states, particularly smaller ones, have modeled their corporate statutes after the Model Business Corporation Act, one of many model sets of law prepared and published by the American Bar Association.

As juristic persons, corporations have certain rights that attach to natural purposes. The vast majority of them attach to corporations under state law, especially the law of the state in which the company is incorporated – since the corporations very existence is predicated on the laws of that state. A few rights also attach by federal constitutional and statutory law, but they are few and far between compared to the rights of natural persons. For example, a corporation has the personal right to bring a lawsuit (as well as the capacity to be sued) and, like a natural person, a corporation can be libeled.

But a corporation has no constitutional right to freely exercise its religion because religious exercise is something that only "natural" persons can do. That is, only human beings, not business entities, have the necessary faculties of belief and spirituality that enable them to possess and exercise religious beliefs.

Harvard College (a component of Harvard University), formally the President and Fellows of Harvard College (also known as the Harvard Corporation), is the oldest corporation in the western hemisphere. Founded in 1636, the second of Harvard’s two governing boards was incorporated by the Great and General Court of Massachusetts in 1650. Significantly, Massachusetts itself was a corporate colony at that time – owned and operated by the Massachusetts Bay Company (until it lost its charter in 1684) - so Harvard College is a corporation created by a corporation.

Many nations have modeled their own corporate laws on American business law. Corporate law in Saudi Arabia, for example, follows the model of New York State corporate law. In addition to typical corporations in the United States, the federal government, in 1971 passed the Alaska Native Claims Settlement Act (ANCSA), which authorized the creation of 12 regional native corporations for Alaska Natives and over 200 village corporations that were entitled to a settlement of land and cash. In addition to the 12 regional corporations, the legislation permitted a thirteenth regional corporation without a land settlement for those Alaska Natives living out of the State of Alaska at the time of passage of ANCSA.

Corporate taxation

In many countries corporate profits are taxed at a corporate tax rate, and dividends paid to shareholders are taxed at a separate rate. Such a system is sometimes referred to as " double taxation", because any profits distributed to shareholders will eventually be taxed twice. One solution to this (as in the case of the Australian and UK tax systems) is for the recipient of the dividend to be entitled to a tax credit which addresses the fact that the profits represented by the dividend have already been taxed. The company profit being passed on is therefore effectively only taxed at the rate of tax paid by the eventual recipient of the dividend. In other systems, dividends are taxed at a lower rate than other income (e.g. in the US) or shareholders are taxed directly on the corporation's profits and dividends are not taxed (e.g. S corporations in the US).

Corporations' criticism

Adam Smith in the Wealth of Nations criticized the joint-stock company corporate form because of the separation of ownership and management.

The directors of such [joint-stock] companies, however, being the managers rather of other people’s money than of their own, it cannot well be expected, that they should watch over it with the same anxious vigilance with which the partners in a private copartnery frequently watch over their own.... Negligence and profusion, therefore, must always prevail, more or less, in the management of the affairs of such a company.

The context for Adam Smith’s term for “companies” in the Wealth of Nations was the joint-stock company. In the 18th century, the joint-stock company was a distinct entity created by the King of Great Britain as Royal Charter trading companies. These entities were awarded legal monopoly in designated regions of the world, such as the British East India Company.

Furthermore the context of the quote points to the complications inherent in chartered joint-stock companies. Each company had a Courts of Governors and day-to-day duties were overseen by local managers. Governor supervision of day-to-day operations was minimal and was exacerbated by the geography of the 18th century.

The sailing time from India to Great Britain was many months and round trip routes often took a year or longer. It was during the interim time period that local managers took advantage of the time delay by plundering the local population at the expense of the interests of shareholders. Bribery and corruption were inherent in this type of corporate model as the local managers sought to avoid close supervision by the Courts of Governors, politicians, and Prime Ministers. In these circumstances, Smith did not consider joint-stock company governance to be honest. More importantly, the East India Company demonstrated inherent flaws in the corporate form. The division between owners and managers in a joint-stock company, and the limited legal liability this division was based on guaranteed that stockholders would be apathetic about a company's activities as long as the company continued to be profitable. Just as problematic, the laws of agency upon which the corporate form was based allowed for boards of directors to be so autonomous from and unconstrained by stockholder wishes that directors became negligent and ultimately self-interested in the management of the corporation.

Legal Scholar and Professor of Law at the University of British Columbia Joel Bakan describes the modern corporate entity as 'an institutional psychopath' and a 'psychopathic creature.' In the documentary The Corporation, Bakan claims that corporations, when considered as natural living persons, exhibit the traits of antisocial personality disorder or psychopathy. Also in the film, Robert Monks, a former Republican Party candidate for Senate from Maine, claims that:

"The corporation is an externalizing machine (moving its operating costs to external organizations and people), in the same way that a shark is a killing machine."

Noam Chomsky has criticized the legal decisions that led to the creation of the modern corporation:

Corporations, which previously had been considered artificial entities with no rights, were accorded all the rights of persons, and far more, since they are "immortal persons", and "persons" of extraordinary wealth and power. Furthermore, they were no longer bound to the specific purposes designated by State charter, but could act as they choose, with few constraints.

Recent events in corporate America may suggest that exploitive behaviour common during the time of Adam Smith may not be a mere historical curiosity.

Influential scholars Frank Easterbrook and Daniel Fischel, as an aside to their primary thesis, limitedly argue that if wealth-maximization is a normative priority of societal policy, then corporate law serves the general welfare by mimicking, without the heavy cost of negotiation, the contractual agreements that would be reached by shareholders, managers and employees. For example:

"Limited liability decreases the need to monitor agents. To protect themselves [in its absence], investors could monitor their agents more closely. The more risk they bear, the more they will monitor. But beyond a point extra monitoring is not worth the cost. Moreover, specialized risk bearing implies that many investors will have diversified holdings. Only a portion of their wealth will be invested in one firm. These diversified investors have neither the expertise nor the incentive to monitor the actions of more specialized agents. Limited liability makes diversification and passivity a more rational strategy and so potentially reduces the cost of operating the corporation."

Other business entities

Almost every recognized type of organization carries out some economic activities (e.g. the family). Other organizations that may carry out activities that are generally considered to be business exist under the laws of various countries. These include:

- Consumers' cooperative

- Partnership

- Limited partnership (LP)

- Limited liability partnership (LLP)

- Limited liability limited partnership (LLLP)

- Limited liability company (LLC)

- Limited company (Ltd.)

- Not-for-profit corporation

- Sole proprietorship

- Trust company, Trust law