From Wikipedia, the free encyclopedia

|

This is a file from the Wikimedia Commons. The description on its description page there is shown below.Commons is a freely licensed media file repository. You can help.

|

Description

| Description |

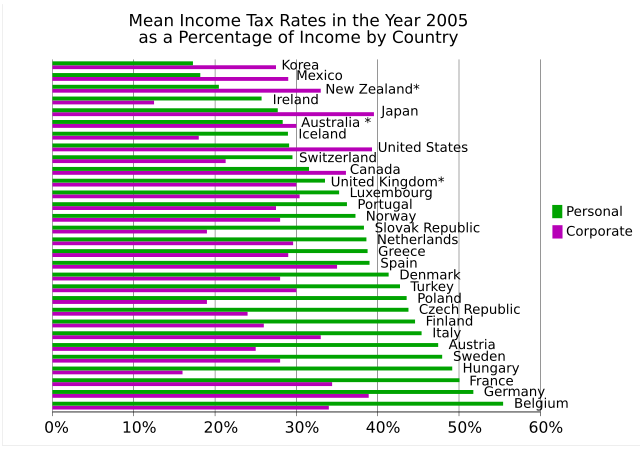

This graph shows average income taxes by country in year 2005. The 'Personal rate' is the average rate of income tax for a worker on the average income in that country. Note Personal rate is calculated using the combined central and sub-central government income tax plus employee and employer social security contribution taxes, as a percentage of labour costs defined as gross wage earnings plus employer social security contributions. The tax wedge includes cash transfers. The 'Corporate rate' is the mean combined corporate income tax rate which includes central and sub-central rates. |

| Source |

Source the OECD http://www.oecd.org/document/60/0,2340,en_2649_34533_1942460_1_1_1_1,00.html table I.2 and table II.1 |

| Date |

|

| Author |

en:User:GameKeeper |

Permission

( Reusing this image) |

see below |

| Other versions |

http://en.wikipedia.org/wiki/Image:Income_Taxes_By_Country.svg |

| Description |

Ce graphique montre la moyenne des impôts sur le revenu (NDT: et certaines autres charges sociales) par pays, pour l'année 2005. Le 'Personal rate' est le taux moyen de taxes (NDT et charges) sur le revenu pour un travailleur sur la moyenne de revenu de ce pays. Le Personal rate est calculé en combinant les impôts locaux et les impots centraux plus les contributions de sécurité sociale des employés, comme un pourcentage du coût du travail defini comme revenus gross wage plus les contributions de sécurité sociale des employeurs. Le tax wedge includ les transferts. Le 'Corporate rate' est la moyenne combinée des impôts sur les entreprises qui inclue les taux des gouvernement centraux et locaux. |

| Source |

Source the OECD http://www.oecd.org/document/60/0,2340,en_2649_34533_1942460_1_1_1_1,00.html table I.2 and table II.1 |

| Date |

|

| Author |

en:User:GameKeeper |

Permission

( Reusing this image) |

see below |

| Other versions |

http://en.wikipedia.org/wiki/Image:Income_Taxes_By_Country.svg |

history on en:wikipedia : * (del) (cur) 21:15, 12 February 2007 . . GameKeeper (Talk | contribs) . . 810×570 (66,999 bytes)

Licensing

|

|

I, the copyright holder of this work, hereby release it into the public domain. This applies worldwide.

In case this is not legally possible:

I grant anyone the right to use this work for any purpose, without any conditions, unless such conditions are required by law.

Afrikaans | Alemannisch | Aragonés | العربية | Asturianu | Български | Català | Cebuano | Česky | Cymraeg | Dansk | Deutsch | Eʋegbe | Ελληνικά | English | Español | Esperanto | Euskara | Estremeñu | فارسی | Français | Galego | 한국어 | हिन्दी | Hrvatski | Ido | Bahasa Indonesia | Íslenska | Italiano | עברית | Kurdî / كوردی | Latina | Lietuvių | Latviešu | Magyar | Македонски | Bahasa Melayu | Nederlands | Norsk (bokmål) | Norsk (nynorsk) | 日本語 | Polski | Português | Ripoarisch | Română | Русский | Shqip | Slovenčina | Slovenščina | Српски / Srpski | Suomi | Svenska | ไทย | Tagalog | Türkçe | Українська | Tiếng Việt | Walon | 中文(简体) | 中文(繁體) | zh-yue-hant | +/- |

File history

Click on a date/time to view the file as it appeared at that time.

|

|

Date/Time |

Dimensions |

User |

Comment |

| current |

00:03, 8 June 2007 |

810×570 (65 KB) |

MaCRoEco |

|

File links

The following file is a duplicate of this file:

The following pages on Schools Wikipedia link to this image (list may be incomplete):